Foxconn is probably well known to tech-savvy investors around the globe. However, Foxconn has a rival, Luxshare, that could also be of interest to many. This summer, Luxshare Precision Industry, bought an iPhone assembly plant and became bigger in the market than Foxconn, that is not the only reason Luxshare is worth consideration.

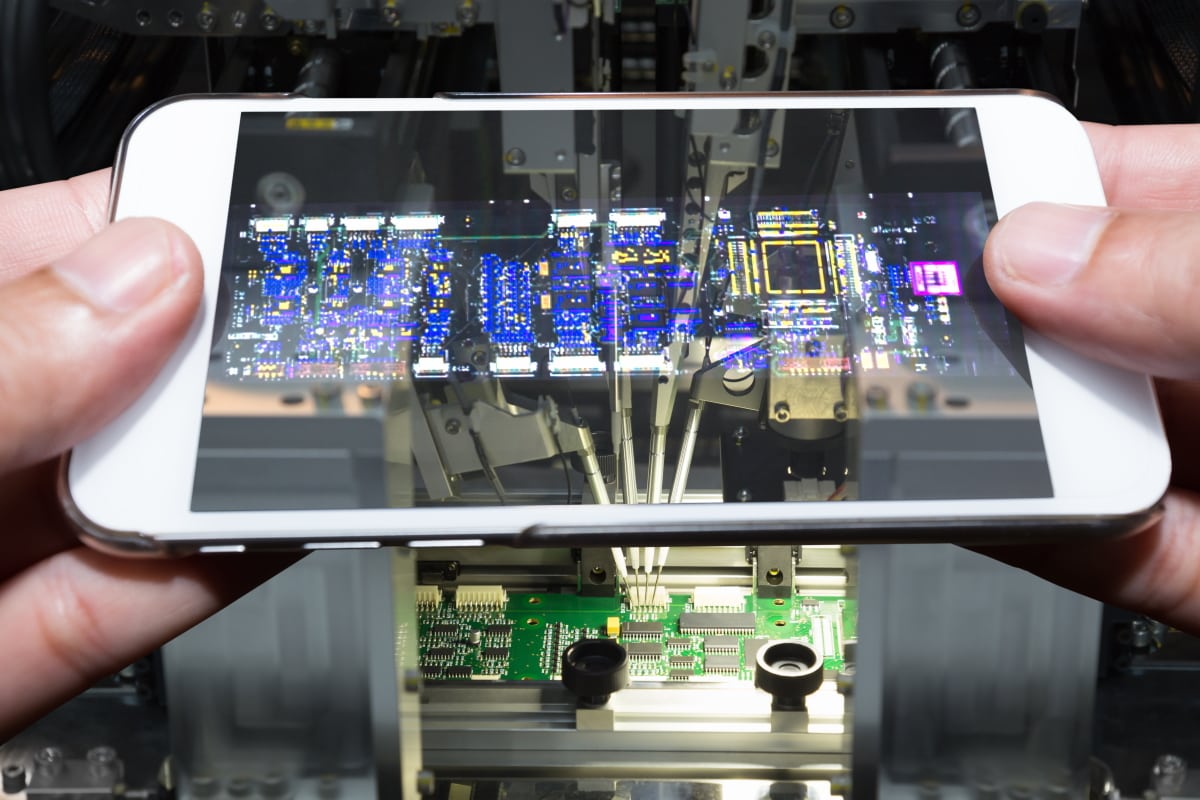

Luxshare is a designer and manufacturer of cable assembly and connector system solutions. It has a market valuation of $35.9 billion as per Forbes. Luxshare was founded in Dongguan, China, by Wang Lai Chun and Wang Lai Sheng in 2004. Co-founder and part owner Wang Lai Chun was declared one the world’s youngest self-made female billionaires at the age of 46 by The Daily Telegraph in 2014. She’s now aged 53 and worth $12 billion.

Luxshare has now been crowned China’s iPhone champion, and its homegrown iPhone maker, it supplies both domestic and international markets and it is certainly a popular Apple supplier.

Luxshare rises in Apple’s favour – to the disadvantage of Foxconn

Taiwanese company Foxconn, otherwise known as Hon Hai Precision, had been Apple’s most significant contract manufacturer for some years. That appears to have changed somewhat with Luxshare eroding Taiwan’s dominance in iPhone manufacture and Apple supply. Founded in 1974 by Terry Gou, Foxconn is also valued at $35.9 billion by Forbes.

Luxshare’s purchase of the Wistron assembly factory in China means that the Chinese company advances from previously supplying Apple with individual components to providing assembled parts and complete devices. Apple appears to have increasingly patronized Luxshare in recent years, helping to advance its revenues five-fold to around $9 billion in five years.

It was reported in July this year that Apple may have encouraged Luxshare to purchase the Wistron factory thus reducing its reliance on Foxconn for iPhone assembly. JP Morgan declared the purchase “not a surprise to the market,” but also only called the deal a “mild negative” for Foxconn.

Apple now constitutes more than 50% of Luxshare’s revenue generation. Nikkei puts Luxshare’s market capitalization at almost $55 billion and Foxconn’s to $11 billion as of August 2020. Luxshare will be the first Chinese company to assemble the iPhone.

Luxshare supplies Microsoft, Google Amazon, HP and Dell as well as Apple. According to Nikkei Asia there are talks that Luxshare plans to acquire further technology suppliers. The company furthermore seems to be acquiescing to Apple’s desire to move production outside of China and it has built manufacturing plants in Vietnam, just 15 minutes away from Foxconn’s own, to make Apple AirPods. There is also a joint venture in place with Merry Electronics, Vietnam, to make acoustic components.

Luxshare taking over the market?

It’s been suggested that Luxshare has received government subsidies designed to support the country’s semiconductor and manufacturing industries. China is keen to further develop its strengths in the technology marketplace and Luxshare’s increasing displacement of Foxconn’s historic prowess in components and assembly is a significant boon.

The rivalry between Luxshare and Foxconn is likely to develop further in 2021. Luxshare is expected to increase its iPhone assembly business. And analysts have predicted it will probably have “limited market shares in new models,” but focus instead on legacy models. Foxconn “could incur some market loss,” with the Wistron-Luxshare plant change.

JP Morgan, earlier this year, went on to estimate that iPhone casings might be higher margin source of revenue for Luxshare. Casing production returns around 25% margins, whilst device assembly is a lower margin revenue source for manufacturers at 5%. Should Luxshare focus on assembly, some predict a supplier price war might ensue, ultimately working in Apple’s favour as the companies compete for Apple’s business.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom