Historically, investing in Chinese equities has been a complex undertaking, off-limits to many foreign investors. But the market is gradually opening up, with overseas listings back on track and higher access via Hong Kong. The Stock Connect scheme has provided a major boost to foreign holdings in the Chinese market, whereas Beijing has amended rules to spur foreign investment.

The Stock Connect scheme, first established in 2014, allows offshore funds to access China’s $10 tn onshore market. Last year, the country opened its derivatives market to qualified foreign investors.

The investment case for Chinese equities is strong as investors are betting on the economic recovery from zero-Covid. The country reported a 4.5% GDP growth in the first quarter of 2023, the fastest pace in a year. The government has set a target of 5% GDP growth for the year, lower than the IMF expectation of 5.2% growth and Morgan Stanley’s 5.7% growth.

Brief introduction to Chinese equities

There are several share classes of Chinese equities. Companies incorporated in the People’s Republic of China can issue A-shares, B-shares and H-shares. The main differences between these share classes are the listing location and the currency in which the shares are traded. Other types of Chinese stocks exist as well, representing shares of Chinese companies incorporated and exchanged outside of China.

Until recently, the onshore Chinese market, A-shares and B-shares, has been mostly off-limits to foreign investors. However, various programmes introduced by the government over recent years offered foreign investors an opportunity to participate in the onshore market. This is significant as stocks are traded on the two Chinese exchanges, the Shanghai Stock Exchange and the Shenzhen Stock Exchange, the second-largest equity market in the world.

The Stock Connect scheme offers 1,586 mainland stocks from the two indices, and foreigners bought $12.3 bn worth of yuan-denominated stocks as of December 17, 2023, as per Goldman Sachs. China has a Stock Connect scheme with Hong Kong as well as Switzerland, which has seen some of the Chinese companies listed on the SIX Swiss Exchange.

On the other hand, several mainland firms have offshore listings which are now secure as the US-China audit issue has been temporarily resolved. The country’s securities watchdog recently published new rules for offshore listings after a freeze it introduced back in July 2021.

MSCI China and other China stock indices

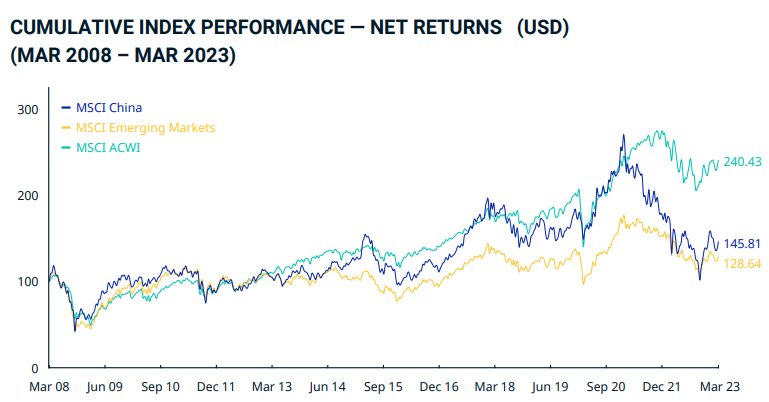

MSCI indices are widely used by the global investment community. Driven by the institutional demand for the asset class, MSCI has been steadily increasing the representation of China A-shares in its global indices. Since MSCI’s initial inclusion announcement in 2018, Chinese onshore equities have experienced billions of dollars of foreign capital inflows.

MSCI has several indices that can be used as a proxy for Chinese equity exposure and performance. The MSCI China Index and the MSCI China All Shares Index are the most common. The major difference between the two is the extent of inclusion of A-shares in the investment universe.

While the MSCI China Index has a cap on A-shares inclusion, the MSCI China All Shares does not. While this might seem like a minor difference, it has a substantial impact on the composition. For example, Consumer Discretionary, Communication Services and Financials make up 64.32% of the MSCI China Index. MSCI China All Shares Index offers more diversified exposure, with the top 3 sectors representing 48.52% of the index, followed by Consumer Staples and Technology both having over 9% allocation.

Some other commonly used indices are the CSI 300, several FTSE China products and the S&P China 500 index. The CSI 300 index tracks the 300 largest and most liquid A-shares listed on both, Shanghai and Shenzhen exchanges. Financials and Consumer Staples account for a large share of the index, and Ping An Insurance is among the largest holding.

FTSE Russell has a substantial range of benchmark indices for onshore and offshore investors. FTSE Total China Connect Index, for instance, includes all major Chinese share classes while FTSE China A50 Index is a flagship index representing the 50 largest A-shares.

The S&P China 500 covers the 500 largest, most liquid Chinese companies, including A-shares and offshore listed Chinese stocks. Financials and Consumer Discretionary have over 15% weightage, followed by IT (13.4%) and Industrial (12.6%).

Getting exposure to Chinese equities

For investors looking to allocate capital to Chinese equities, there are two simple and effective options. One is through an ETF tracking one of the major indices. ETFs offer low-cost, beta exposure to the Chinese market. iShares Trust – iShares China Large-Cap ETF, iShares MSCI China ETF, Invesco Golden Dragon China ETF and Deutsche Xtrackers Harvest CSI 300 China A-Shares Exchange are some of the ETFs worth considering for China exposure.

Another option is to use an actively managed mutual fund. Active management could be particularly effective in a market like China. Research by an asset manager, Invesco, for example, found that “median managers outperformed the benchmark A-share index CSI 300 by more than 4% a year, while top quartile managers outperformed by over 12% a year.” Instead of replicating an index, active managers look for undervalued opportunities to generate alpha above their benchmark.

Amongst funds with good ratings are the JPMorgan China A-Share Opportunities Fund and the Allianz China A-shares Fund. Abrdn manages a strategy with a focus on sustainability, the China A Share Sustainable Equity Fund. Fidelity, HSBC, Schroders, and Neuberger Berman also have active management products available to investors looking for exposure to Chinese equities.

Chinese Equities: worth a bet

Overall, China offers an exciting investment opportunity. The A-shares market, in particular, is still under-owned and underrepresented in most indices. Chinese shares have a low correlation to traditional equity markets and have the potential to generate sustainable long-term outperformance.

Tracking MSCI China index might be an easy way to get the necessary exposure. For more active investors, however, plenty of mutual funds exist targeting different areas of the Chinese market.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom