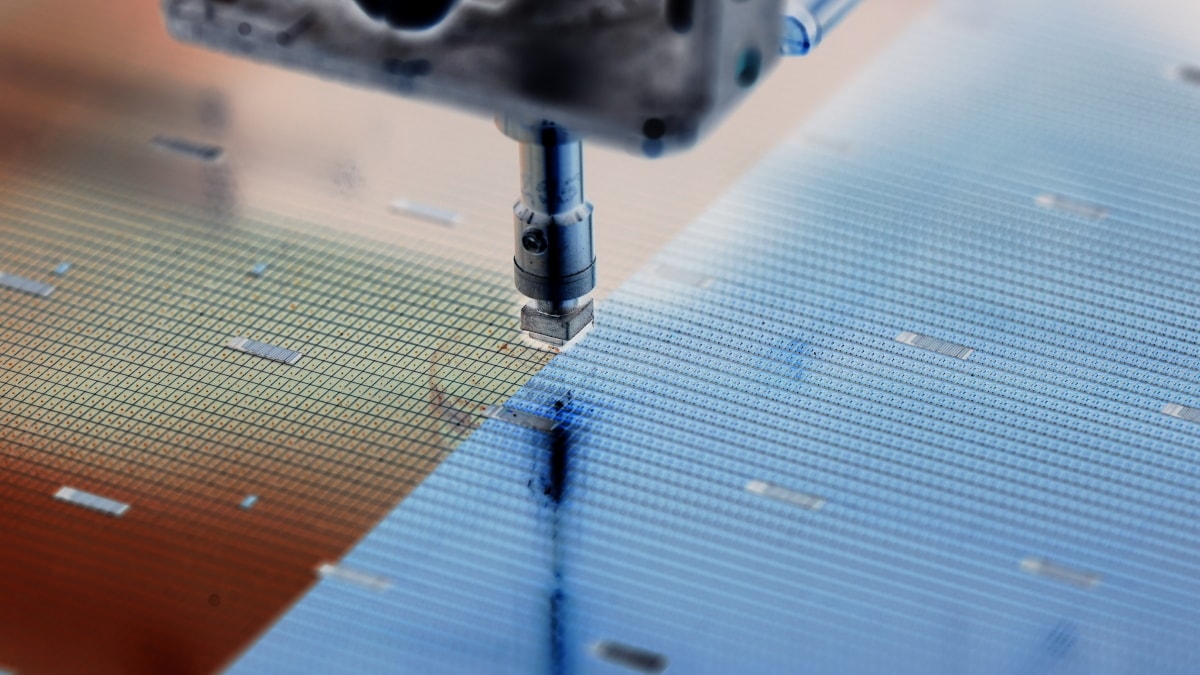

The Covid-19 pandemic has contributed to a rising supply crunch of chips that are used in a number of industries from the vehicle market, consumer electronics sector, 5G phones, and infrastructure to IT equipment. As per IHS Market projections, the lack of chips won’t stabilize until the second quarter of 2022. In order to meet the increasing demand of semiconductors, top chipmakers from all over the world are raising production outputs.

As Nikkei Asia reports, total inventory at the world’s nine leading chipmakers, namely TSMC, Intel, Samsung Electronics, Micron Technology, SK Hynix, Western Digital, Texas Instruments, Infineon Technologies, and STMicroelectronics, rose to a historic high of $64.7 bn by June 2021.

However, low vaccination rates and rising infections in Asia are adding to the problem as they are causing shutdowns of plants assembling all types of chips. Assembly and test locations are concentrated in Asian countries like China, South Korea, Japan, Singapore, Philippines, Indonesia, Thailand, Vietnam, and Malaysia. Vaccination rates are reported to be less than 6% for many of these countries, with the exception of Singapore and Malaysia, according to the Center from Strategic and International Studies.

Investing in production and talent

To bring vital semiconductor manufacturing onshore, top chipmakers from the industry in Asia Pacific nations like South Korea, Taiwan, China and Japan have announced massive expansion plans in the semiconductor industry. Due to national security concerns over chips, the US and Europe are also pouring money into the sector and urging top chipmakers to bring chip production onshore.

The world’s largest chipmaker – Taiwan Semiconductor Manufacturing Company (TSMC) – has not only optimized production lines in January-June but also expanded production of automotive chips by 30% in the same period from a year earlier.

Aiming to be the top chipmaker by 2030, South Korea’s Samsung Electronics had announced its plans to invest $151 bn, earlier in May. In its latest investment statement, Samsung said that it is setting aside $205 bn for investments into semiconductors, biopharmaceuticals, and the next-generation telco units over the next 3 years. To expand its contract chipmaking business, it has also announced a $17 bn investment for building a new foundry plant in the US. Samsung has earlier announced an investment of $144 bn under its Vision 2030 plan, to become the world’s top foundry player by then.

Taiwanese company United Microelectronics Corp. (UMC) also announced plans to spend $5.36 bn over the next 3 years to raise capacity in the southern Taiwanese city of Tainan.

Furthermore, Taiwanese authorities plan to invest at least $300 m over the next decade to create graduate programs for the semiconductor industry and reduce brain drain. Amid tensions with the US, China has made chip production a top priority over the past few years. To keep up with demand, Beijing recently unveiled plans to increase the number of microelectronics schools as it needs an additional 230,000 engineers by 2022.

Shortage contributes to revenue growth

With the Covid-19 pandemic driving up the demand for electronic devices, the electronics and semiconductor industry’s revenue outlook continues to remain strong. The latest data from global chipmaking powerhouses have delivered robust revenue earnings.

TrendForce reported that the quarterly total revenue of the top 10 global foundries rose by 1% QoQ to a record high of $22.75 bn during the first quarter of 2021. TSMC maintained its first-place position with quarterly revenue of $12.9 bn, up 2% quarterly. Meanwhile, Samsung took the second position, even after it posted a small QoQ drop of 2% in its foundry revenue for 1Q21 to $4.11 bn. Where TSMC commands a 55% market share of the global foundry revenues, Samsung takes the runner-up position at 17% in Q121.

According to Mark Hawtin, Investment Director at GAM Investments, valuations expanded to extreme levels by historic standards in the chip sector, as much hype now surrounds the industry.

“Semiconductors have steadily become more expensive over the last 10 years when measured by price to sales ratios rising from less than 2x in the global financial crisis to over 7x today. This is at a time when gross margins have, in some cases, increased by 20%. The result is a huge expansion in price-to-earnings ratios that in many cases we find hard to justify,” Hawtin said.

Vijay Anand, Analyst at Schroders, expects the Internet of Things, AI, advanced communications, and rising automotive demand to provide structural growth in the semiconductor sector for many years to come.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom