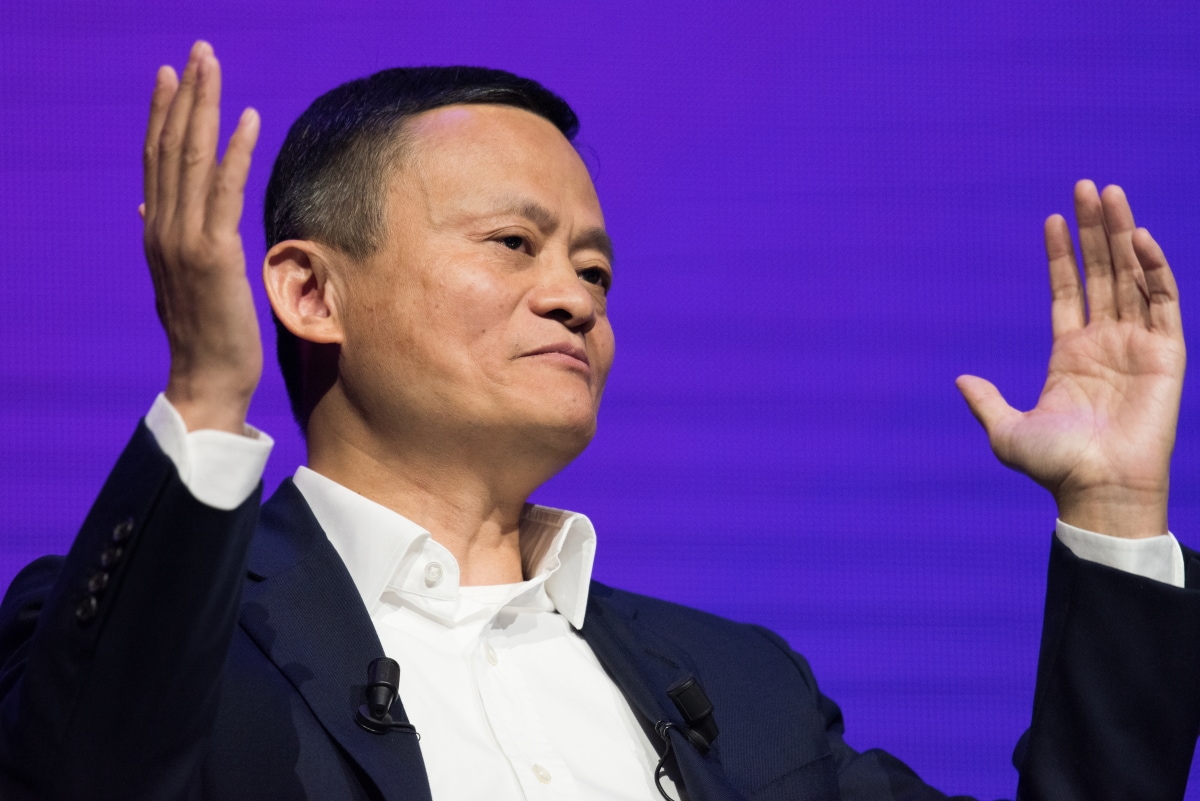

Was als größter Börsengang der Welt erwartet wurde, wurde in letzter Minute von den chinesischen Regulierungsbehörden gestoppt. Kurz zuvor hatte Ant Group und Alibaba-Gründer Jack Ma das regulatorische Umfeld und die staatlichen Banken des Landes kritisiert. War Ma zu kritisch?

Die Ant Group ist ein Spin-off-Finanzunternehmen des chinesischen Tech-Konglomerats Alibaba. Der Hightech-Finanzsupermarkt wurde erst vor sechs Jahren gegründet und gilt als eines der am schnellsten wachsenden und größten Unternehmen der Geschichte.

Ant sollte am 3. November 2020 sowohl an der Shanghaier Börse als auch an der Börse in Hongkong notiert werden, aber die Aufsichtsbehörden beider Börsen beschlossen, den Börsengang zwei Tage vor dem geplanten Termin auszusetzen. Die Begründung: Es gebe große Probleme im Zusammenhang mit Änderungen im regulatorischen Finanztechnologie-Umfeld.

Nach der Ankündigung der Aussetzung durch Shanghai folgte die Börse in Hongkong diesem Beispiel. Der Börsengang sollte rund 37 Mrd. USD einbringen und den Marktwert des Finanzunternehmens auf mehr als 300 Mrd. USD steigern.

Ma zu kritisch gegenüber China?

Ende Oktober 2020 hielt Ma, Großaktionär der Ant Group, eine sehr offene Rede auf einer Finanzkonferenz in Shanghai: “China hat kein systemisches Finanzrisikoproblem. Das chinesische Finanzwesen ist im Grunde genommen nicht risikobehaftet; das Risiko kommt vielmehr aus dem Fehlen eines Systems. China benötigt heute Strategie-Experten, keine Schreibtischtäter.”

Ma kritisierte auch die chinesischen Banken und nannte sie “Pfandhäuser”, die Kredite an Unternehmen vergeben, “die kein Geld brauchen”. Das Ergebnis sei, dass sich viele gute Unternehmen in schlechte Unternehmen verwandelt hätten.

Kurz darauf wurde der Börsengang der Ant Group ausgesetzt und Ma und zwei Führungskräfte der Ant Group – Executive Chairman Eric Jing und Chief Executive Simon Hu – wurden von chinesischen Finanzaufsichtsbehörden befragt. Die Ant Group erklärte in einer Pressemitteilung, dass sie eng mit der Shanghaier Börse und anderen regulatorischen Abteilungen zusammenarbeitet, um den Börsengang weiter voranzutreiben.

Als Folge der Aussetzung fielen die Aktien von Alibaba in Hongkong um 7,1%, wobei Ma rund 3 Mrd. USD verlor.

Abgesehen von der Aussetzung des Ant-Börsengangs hat die chinesische Kartellbehörde, die State Administration of Market Regulation, offiziell eine Untersuchung gegen den Mutterkonzern Alibaba wegen angeblicher monopolistischer Geschäftspraktiken eingeleitet, einschließlich der Politik, E-Commerce-Händler zu verpflichten, eine einzige Plattform als exklusiven Vertriebskanal zu wählen.

Alibaba und Ant Group – wie groß ist der Schaden?

“Regulatorische Warnungen, Klagen und schlechte Presseberichterstattung über Alibabas wettbewerbswidrige Praktiken sind für Investoren nichts Neues”, sagt Analyst Oshadhi Kumarasiri von LightStream Research, der auf Smartkarma publiziert. “Eine Reihe von Konkurrenten und Händlern haben schon früher Klagen gegen Alibaba wegen wettbewerbswidriger Praktiken eingereicht, aber die chinesische Regierung hatte bis zu den öffentlichen Äußerungen von Jack Ma gegenüber den chinesischen Regulierungsbehörden und der Regierung keine feste Haltung gegen die Praktiken von Alibaba eingenommen. Ein Zerwürfnis zwischen der Regierung und Ma könnte zur Aussetzung des Ant-Börsengangs und zur Untersuchung von Alibabas mutmaßlichen monopolistischen Praktiken geführt haben.”

Darüber hinaus haben die Behörden in Peking nun auch die Ant Group angewiesen, ihre Aktivitäten zurückzufahren. Die Regulierungsbehörden sagten, Ant’s Corporate Governance sei “nicht solide” und die Gruppe müsse “illegale Kredit-, Versicherungs- und Vermögensverwaltungs-Finanzaktivitäten verändern”.

“Dies ist ein Angriff auf eines der lukrativsten Geschäfte von Jack Ma”, sagt Kumarasiri. “Sein Engagement bei Alibaba ist begrenzt, seit er 2019 von seinem Posten als Vorstandsvorsitzender zurückgetreten ist. Allerdings hat er über zwei in der VR China gegründete Kommanditgesellschaften immer noch die Kontrolle über die Geschäfte von Ant, und ein erheblicher Teil von Ma’s Vermögen ist derzeit an die Ant Group gebunden. Daher ist der beste Weg, es Ma mit minimalen Auswirkungen auf den Rest der Investoren heimzuzahlen, über die Ant Group.”

Unterdessen ist Ma seit Anfang November nicht mehr gesehen worden und die Spekulationen über seinen Verbleib sind vielfältig. Einige Beobachter befürchten das Schlimmste und fühlen sich an das Verschwinden anderer Milliardäre in China erinnert. Andere Analysten sagen, dass Ma höchstwahrscheinlich einfach untergetaucht ist. Shaun Rein, ein in Shanghai ansässiger Unternehmensberater, der sich mit Alibaba-Managern und Personen, die Ma kennen, getroffen hat, sagte, dass keiner von ihnen berichtet, dass der Milliardär in rechtlichen Schwierigkeiten steckten würde.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom