US President Donald Trump and Chinese President Xi Jinping agreed on a temporary ceasefire in their trade war on Saturday. The US has agreed to a 90-day extension to introduce additional tariffs. Beijing has agreed to buy a “substantial amount” of US products to reduce the trade imbalance.

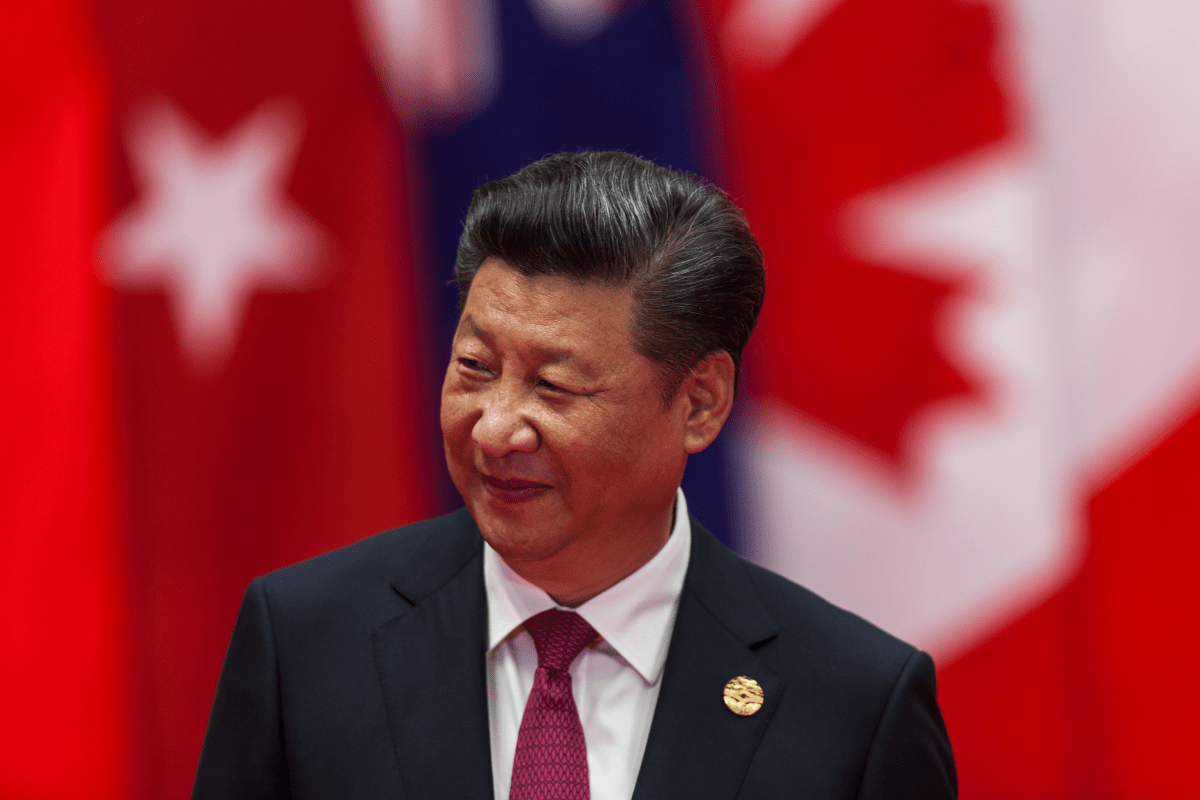

Xi Jinping: “Cooperation is the best option”

The ceasefire took place on the fringes of the G-20 summit in Buenos Aires, Argentina. The two heads of state discussed how to defuse trade relations between the world’s two leading economies.

At the opening of the summit, Xi Jinping declared his willingness to improve bilateral relations. “China and the United States assume important responsibilities in promoting peace and prosperity in the world,” he said, adding: “Cooperation is the best option for the two countries.”

The talks were the prerequisite for difficult negotiations expected to last until March. They will deal with structural issues which are difficult to resolve and which stand in the way of a lasting agreement. Many experts believe that the two countries will soon clash again in the trade conflict.

Difficult negotiations on technology transfer and cyber-attacks

According to the White House, Donald Trump agreed to postpone the tariff increase on Chinese goods worth $200bn to 25 percent, which had been planned for January 1. Meanwhile, Beijing immediately began to purchase an unspecified but “very large quantity of agricultural, energy, industrial and other products” and to expand its purchases of agricultural products.

Discussions on structural reforms in five areas – forced technology transfer, intellectual property protection, duty exemptions, cyber-attacks and cyber-theft, and services and agriculture – are to begin immediately. If there is no progress after 90 days, the US will implement the planned tariff increase.

The heads of state and government spoke for more than two and a half hours at dinner. Both Trump and Xi said it had been “very successful”. The start of the dinner had been postponed by an hour to give the leaders more time for other issues, including the denuclearization of North Korea.

China wants to eliminate trade imbalance

Xi also said that he is “open to the approval” of the merger of US semiconductor company, Qualcomm, and Dutch chip manufacturer, NXP. Beijing had blocked the merger for ‘antitrust’ reasons after US and European authorities had approved it. US President Donald Trump was quoted as saying, “This was a fantastic and productive meeting with unlimited opportunities for the US and China.”

Speaking to journalists after the summit, Chinese Foreign Minister Wang Yi said China had agreed to import more US goods and “gradually eliminate the trade imbalance”. The Chinese side announced neither the date for the negotiations nor details of the structural reforms. However, reaching agreement on such complex issues as forced technology transfer, intellectual property protection and cyber-theft within three months is likely to be extremely difficult.

Christine Lagarde: Pressure on emerging markets has increased

Increasing tensions between Washington and Beijing have shaken global financial markets and economies. Global trade volumes began to weaken in the third quarter, even before the effects of tariffs were felt. Asian manufacturers in particular are feeling the effects of the crisis. Taiwan, for example, recorded a significant decline in the purchasing managers’ index for the manufacturing sector in October. This fell from 50.8 in September to 48.7.

At the G-20 summit, Heads of State and Government expressed their concern about the situation. The director of the International Monetary Fund, Christine Lagarde, called for an immediate ceasefire. “Pressure on emerging markets has increased and trade tensions have begun to have a negative impact and increase downside risks,” she said in a statement released at the end of the summit. Asian investment experts are now talking about panic in the equity markets.

Xi Jinping wants to exclude ‘Made in China’ and state subsidies

The US had imposed additional tariffs on Chinese goods worth $250bn. China reacted immediately with countermeasures. Although the two camps agreed on a temporary peace treaty, the tariff sanctions were not lifted. This suggests that the trade war is continuing despite the announced deadline.

About the tariff increase originally planned for January, Donald Trump had said that $267bn of tariffs could be levied on Chinese goods. In fact, this would mean that all Chinese exports to the US would then be affected.

Also not on the agenda were the high-tech production initiative, Beijing’s ‘Made in China 2025’, and state industrial subsidies. These issues are considered taboo by Xi Jinping. This wound is likely to be the focus of further debate in the US. It will, therefore, be difficult to improve the increasingly cool relationship in the foreseeable future.

Australia

Australia China

China India

India Indonesia

Indonesia Japan

Japan Malaysia

Malaysia Philippines

Philippines Singapore

Singapore South Korea

South Korea Taiwan

Taiwan Thailand

Thailand Vietnam

Vietnam Germany

Germany Hong Kong

Hong Kong USA

USA Switzerland

Switzerland Singapore

Singapore

United Kingdom

United Kingdom